Death, disability, disease, all are realities seldom talked about. However, all three are realities we cannot possibly overcome with certainty. Term insurance is one tool, which can save you and your family from the financial hardships brought upon by these three and similar disastrous conditions.

Hence, all individuals who have financial dependents should buy a term insurance policy. They can be:

PARENTS

A term policy will act as a source of financial support for the children, ensuring that they do not miss life’s opportunities.

YOUNG INDIVIDUALS

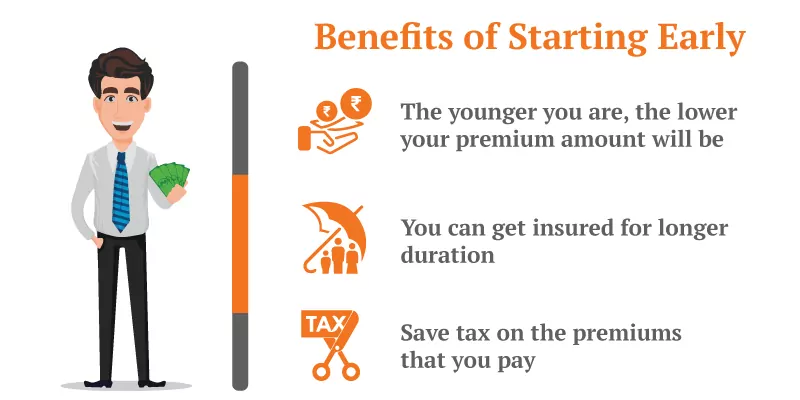

Young professionals who do have many financial liabilities can benefit from lower of term premiums insurance plans.

NEWLY-MARRIED

With a term insurance plan, you can secure the financial future of your spouse, giving her a truly long-lasting gift.

Consider, for example, a family of four, where the father is the primary breadwinner & has bought a term insurance policy. The family needs about Rs.50,000 a month to fund regular expenses like rent, food, other groceries, electricity, water, education fee, etc. Debts, if any, are over and above this.

In case of an unfortunate event, life continues, and so do these quintessential expenses. The family will still need Rs. 30,000 to 40,000 a month to meet all their needs. In such an eventuality, opting for the best term insurance plan can provide your loved ones with adequate financial support in the following ways:

- A lumpsum to meet their immediate needs

- A regular income to meet their household expenses (if opted)

The loss of life cannot be compensated. However, a term insurance plan can help to tide over the financial requirements of a family.

SENIOR CITIZEN

Term insurance for Senior citizens provides a greater degree of financial security to their dependents, such as spouse, thus providing them with a lifestyle they deserve even in their absence

HOUSWAIFE Term insurance for housewife can ensure extra financial security by covering education costs, marriage costs, loans, and health expenses at present and in the future. It offers payouts against insurance premiums paid by the policyholder.

WOMENTerm Insurance for women can ensure extra financial security by covering education costs, marriage costs, loans, and health expenses at present and in the future. It offers payouts against insurance premiums paid by the policyholder.

SELF-EMPLOYEDTerm Insurance for Self-employed can ensure extra financial security by covering education costs, marriage costs, loans, and health expenses at present and in the future. It offers payouts against insurance premiums paid by the policyholder